If you would like become approved to have car loan investment, don’t simply wander on a dealership to find the auto you prefer. Appear prepared to make certain that you are in the best updates in order to score a decreased-rates financing.

If you are obtaining an auto loan, you might help a lender make a decision which is favorable to help you you because of the taking the proper paperwork along with you and finding out how your credit score influences the pace you are given. Otherwise can get a car loan otherwise how to financing a motor vehicle, keep reading.

The new Records Had a need to Get a car loan

Very, precisely what do you ought to get a car loan? When you make an application for another type of car loan you’ll need particular data files to prove some thing, like your earnings plus address. Here are the records you need to get a car loan.

step one. Evidence of Income

Really loan providers require facts you to a borrower is actually definitely making earnings to make sure they can create their car payment. The best way to fulfill it requirement would be to render good shell out stub that is less than 30 days old and suggests your year-to-big date income.

While you are self-operating, you will want taxation statements and you may bank statements. Fundamentally, loan providers want 24 months regarding taxation record however, might inquire about possibly four; additionally you would like bank comments about previous 3 months.

dos. Proof Residence

A loan provider must be certain that your target towards car loan application. You may have several options to prove which you real time there: You can give a software application statement or any other business telecommunications that you will get at your most recent address. You will also need bring a legitimate driver’s license if you plan to drive aside which have a car or truck.

step 3. Proof Insurance rates

State statutes want that trucks while on the move feel insured, therefore, the lender has to understand you have adequate coverage just before he is able to make you an auto loan. For those who have currently purchased insurance rates, bring records.

If you don’t have coverage, you’ll probably be in a position to telephone call an insurance coverage organization about provider and you can safe it. Money from agent, however, would not allow you to comparison shop to find the best rules rates off their lenders. When you yourself have a https://paydayloanalabama.com/evergreen/ great relationship with the lender, such as for example, you’re able to get a much better auto loan rate that have an effective preapproved auto loan than simply you would from the provider.

4. Identity

Discover an auto loan you ought to provide proof their term. Needed a photo ID together with your trademark inside, a recently available domestic bill on your own identity with the exact same address since your ID, as well as 2 days from most recent lender statements. Almost every other acceptable types of ID become a great passport, a national-granted cards such as good Medicare ID, stock permits, and you may titles to help you a house or other vehicle.

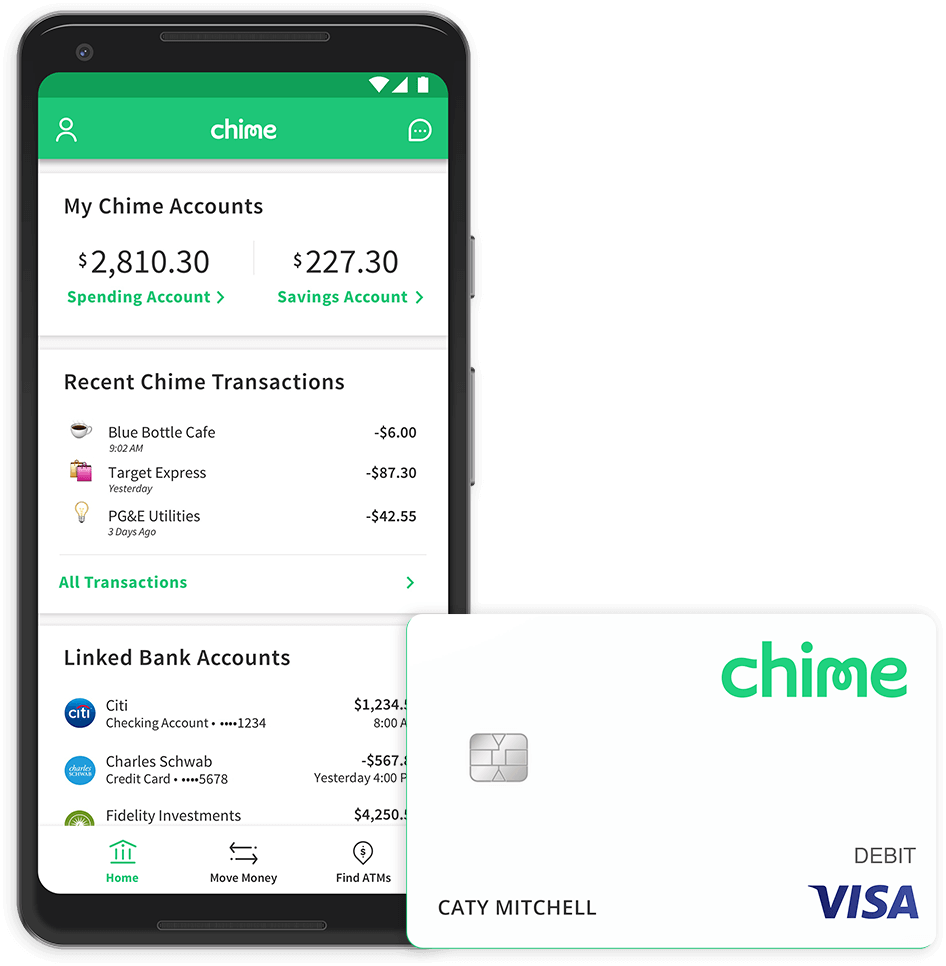

5. Credit and Financial history

Lenders are worried along with your latest and you can past profit, as well as your newest debt-to-money proportion – and/or percentage of your month-to-month gross income one to visits investing expenses – as well as your credit history and you may credit rating.

You don’t need to offer anything – the lending company have access to this post along with your basic information that is personal as well as your consent. Just be conscious the lender usually familiarize yourself with your existing and you will past personal debt background.

six. Vehicles Guidance

When you find yourself making an application for a good used car mortgage, needed a number of information regarding the car you will be to order. The lender would like to document the car’s cost, identity matter, season, generate, model, distance, unique name and you may one liens that will be involved.

The vehicle broker is sometimes bound by the fresh new used-car rule to offer an extensive customer’s guide into the car you are purchasing. One to book provides the suggestions you will have to make an application for a auto loan, and information regarding the rights and you can responsibilities. You really need to very carefully feedback you to guide and learn what you before you could sign up the brand new dotted line.

7. Trade-When you look at the Documents

If you find yourself exchange in a vehicle you’ll need the identity and you can registration files – and every other data that can help the financial institution know very well what the new trading-in vehicle is worth. As the car’s worthy of usually impression just how much financing you will get, make sure to render these products along with you so you’re able to improve your mortgage.

Ways to get Acknowledged Having an auto loan

You might improve likelihood of getting approved for a financial loan and taking good price. Lenders usually look at your credit when you look at the recognition techniques, so that you will be, too. Eliminate your credit report off all around three enterprises – it is free one time per year therefore won’t apply to their borrowing score – to determine what’s on your own report.

If you find one incorrect recommendations, go after for every single bureau’s advice on the best way to conflict credit file errors. Including, consider consolidating several credit cards and you may paying off as much obligations as possible. Eventually, intimate a few bank card levels for those who have a lot of revolving loans, but keep your earlier accounts unlock – borrowing from the bank decades affects their rating.

Whether you are considering a put or the newest car finance bargain, you might be inquiring a lender to look at a threat. Set brand new lender’s mind – in addition to underwriter’s – at ease by delivering very important factors, that have crucial guidance in a position, and you may installing the trouble and come up with on your own a more attractive borrower.